News

48V Mild Hybrid and Huawei Tech Integration: The New Audi A5L Faces a Challenging Road Ahead

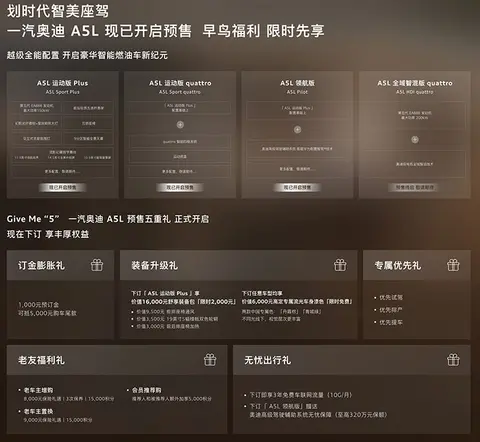

On June 20, 2025, the FAW Audi A5L officially opened for pre-sale. Positioned as the successor to the A4L, this new model is built on the advanced PPC platform, featuring the E3 1.2 electronic architecture and Huawei's QianKun intelligent driving system. These new elements signal Audi's bold attempt to regain momentum in the modern era, carrying the last hopes for a turnaround in the Chinese market.

However, amidst a trust crisis for the Audi brand and its faltering transition to electrification, this gasoline-powered vehicle wrapped in Huawei tech feels like a gamble against the tide of the times. Audi's recent announcement to re-prioritize its combustion engine strategy was met with skepticism, seen not as strategic resolve but as a sign of indecision in the face of the electric vehicle revolution.

Product Highlights and Design Features

In terms of product strengths, the new Audi A5L showcases the refined craftsmanship expected of a German luxury sedan. Its front end sports a hexagonal honeycomb grille, complemented by newly designed Phantom Halo emblems and programmable digital LED daytime running lights composed of 53 LED units. The side profile emphasizes a long wheelbase, short overhangs, and large wheels, incorporating the curved roofline design of the Audi TT for a clean, powerful look.

Compared to its overseas counterpart, the A5L gains extended dimensions with measurements of 4908/1860/1442 (1462) mm and a wheelbase of 2969 mm. The model also features semi-hidden dual-security door handles, integrating electronic and mechanical locks. This two-step operation ensures manual door opening in emergencies, even if the electronic system fails.

Additionally, the second-generation OLED taillights include 364 lighting units capable of displaying intricate and clear images. Interactive lights have been added for scenarios like automated parking or emergencies, utilizing specific triangular light symbols within the digital signature to warn other road users and enhance safety.

Inside, the A5L follows a family-oriented design, featuring a three-screen setup (11.9-inch digital instrument cluster, 14.5-inch central touchscreen, and 10.9-inch passenger screen) along with a 13.1-inch W-HUD. Four interior color options add to the high-tech ambiance. The seats offer premium features, including adjustable 60mm leg supports for the front row, nine-mode massage functions for the rear, and a nine-zone panoramic roof. The cabin also includes a B&O 20-speaker system with noise compensation for a true luxury experience.

Powertrain and Intelligence: Compromises in Technology

Despite these upgrades, the A5L's powertrain and market positioning reveal significant shortcomings. The fifth-generation EA888 2.0T engine, equipped with VTG variable geometry turbo technology, offers 150 hp and 204 hp low- and high-power versions. Unfortunately, these figures fall short compared to competitors in the same segment.

The car's 48V mild hybrid system, touted by Audi as a "technological upgrade," is essentially a transitional measure to meet European emission regulations. In an era dominated by fully electric, hybrid, and extended-range systems, this "pseudo-hybrid" technology feels outdated.

While the hybrid version features HDI dual-motor all-domain intelligent hybrid technology, enabling limited pure electric driving and parking functions, its P3 parallel hybrid architecture with 18 kW motor power and 25 kW energy recovery power falls behind the advanced hybrid systems from Chinese brands like BYD DM-i and Geely Leishen.

On the intelligence front, Audi's reliance on Huawei's QianKun driving system reveals its struggles. While equipped with extensive hardware—including two dual-laser LiDARs, six millimeter-wave radars, 13 cameras, and 12 ultrasonic sensors—the system's reliance on "add-on" solutions exposes the limitations of its gasoline-based electronic architecture.

Notably, the laser LiDAR embedded in the front bumper for aerodynamic purposes is prone to malfunction in rainy or snowy conditions due to dirt accumulation. Additionally, the system's 500W power consumption, paired with the 48V mild hybrid setup, highlights compatibility issues, undermining system reliability. These challenges reflect traditional automakers' struggles in transitioning to intelligent vehicle technologies.

Brand Trust Crisis and Strategic Missteps

Audi's decline in the Chinese market has been years in the making. In 2023, Audi's sales in China reached 729,000 units, trailing behind BMW (824,900 units) and Mercedes-Benz (765,000 units). Since 2019, Audi has consistently lagged behind its competitors, even after sacrificing profitability to maintain market share.

The main reasons for this decline include dealer management issues and frequent dealership closures. In November 2024, "Tianjin Yonghao Audi," the largest Audi dealership in Tianjin, abruptly shut down, leaving over 1,000 customers with losses exceeding $13.92 million. Similar incidents have repeatedly occurred, damaging consumer trust and significantly impacting Audi's brand image and sales.

In terms of electrification, Audi has lagged behind its competitors. While Mercedes-Benz's EQ lineup and BMW's i series gained momentum, Audi's e-tron struggled to make an impact. The recent pivot back to combustion engine strategies seems less like a bold move and more like a retreat in the face of setbacks. In a market increasingly dominated by electric vehicles, Audi's reliance on gasoline-powered models is a risky strategy.

Pricing challenges further complicate matters for the A5L. In the BBA trio, Audi has gained a reputation as the "discount king," with new models often seeing significant price cuts soon after launch. For example, the Audi Q5L, initially priced at $55,540, saw discounts of up to $13,930 at dealerships. This trend encourages consumers to delay purchases, anticipating price reductions, which erodes profit margins and damages Audi's premium image.

Amid a rapidly evolving luxury car market, where new brands are establishing themselves and traditional brands are accelerating electrification, the Audi A5L—a gasoline-powered vehicle with limited technological and intelligent capabilities—struggles to replicate past successes.

Audi's decision to re-emphasize its combustion engine strategy increasingly resembles the stubbornness of a fading aristocrat. In the midst of a transformative era for the automotive industry, such reluctance to adapt could turn Audi into the "Nokia" of the car world, missing its last chance for meaningful transformation. The A5L could become the first casualty of this strategy—not a marker of Audi's revival but a symbol of its decline. As consumers vote with their wallets, this ill-timed model may hasten Audi's marginalization in the Chinese market.

In conclusion, while the A5L offers upgrades in design, interior, and some intelligent features, its technical shortcomings, pricing challenges, and brand trust issues weigh heavily. In a fiercely competitive luxury car market, facing strong rivals like BMW and Mercedes-Benz and the rapid rise of Chinese EV brands, the A5L's future looks uncertain.

History is unforgiving to laggards. The Audi A5L's launch may mark the beginning of a gamble destined for failure.